Top 10 Takeaways From AutoSens Europe 2024

Sharing trends that will shape automotive software development in the months to come.

The “2024 State of Automotive Software Development Report”, published by Perforce Software, Automotive iQ and Eclipse Foundation, delves into these advancements, offering a comprehensive overview of the current trends, challenges, and innovations. This year’s Report, which includes responses from nearly 600 automotive development professionals globally, emphasizes the shift towards AI and ML-driven design processes.

In particular, the Report reveals that AI and ML influence everything from safety systems to autonomous driving capabilities. As the automotive industry grapples with the demands of increased vehicle connectivity, strict safety standards, and the push towards electric vehicles, the role of AI and ML becomes even more critical, offering an effective solution to streamline development, optimize performance, and accelerate innovation in the face of these evolving challenges.

This article outlines the key takeaways from the latest Report, focusing on how AI and ML are reshaping automotive design. By understanding these trends, industry professionals can better navigate the evolving technological landscape and leverage AI and ML to drive innovation and competitiveness in automotive design.

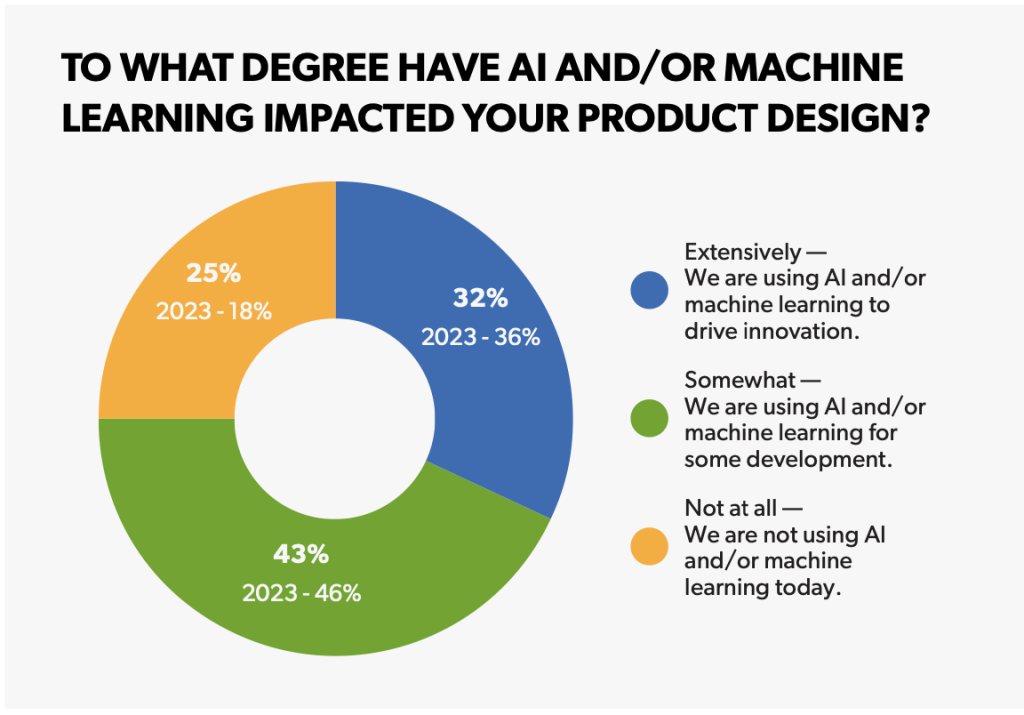

AI and ML technologies are being used to enhance various aspects of automotive engineering, from improving vehicle safety features to optimizing performance and facilitating the development of autonomous driving systems. According to the 2204 State of Automotive Software Development Report, 43% of respondents are already somewhat incorporating AI and ML into their development processes, which is 3% down from 2023, while 32% (4% down from 2023) are using them extensively to drive innovation.

This significant adoption highlights the growing recognition of AI and ML as essential tools for driving innovation in the automotive industry.

However, the Report also notes that “those who are not using AI/ML at all in automotive development increased from 18% to 25% year over year.” This trend suggests that while these technologies are strongly adopted, there are still barriers to their widespread implementation. These barriers could include factors such as the high cost of integrating AI and ML technologies, a lack of skilled personnel, or uncertainty about the return on investment.

Despite these challenges, the overall trend indicates a positive trajectory towards greater AI and ML adoption, driven by the need to stay competitive in a rapidly evolving market.

In addition to the general adoption trends, the Report highlights areas within automotive design where AI and ML are making significant impacts. AI-driven predictive maintenance is helping manufacturers reduce downtime and maintenance costs by predicting potential issues before they become critical. Machine Learning algorithms are also used to enhance advanced driver-assistance systems (ADAS), providing real-time data analysis to improve safety and efficiency. Furthermore, AI and ML are crucial in developing autonomous vehicles, enabling systems to learn and adapt to various driving conditions. These advancements improve the current state of automotive technology and pave the way for future innovations that will redefine the industry.

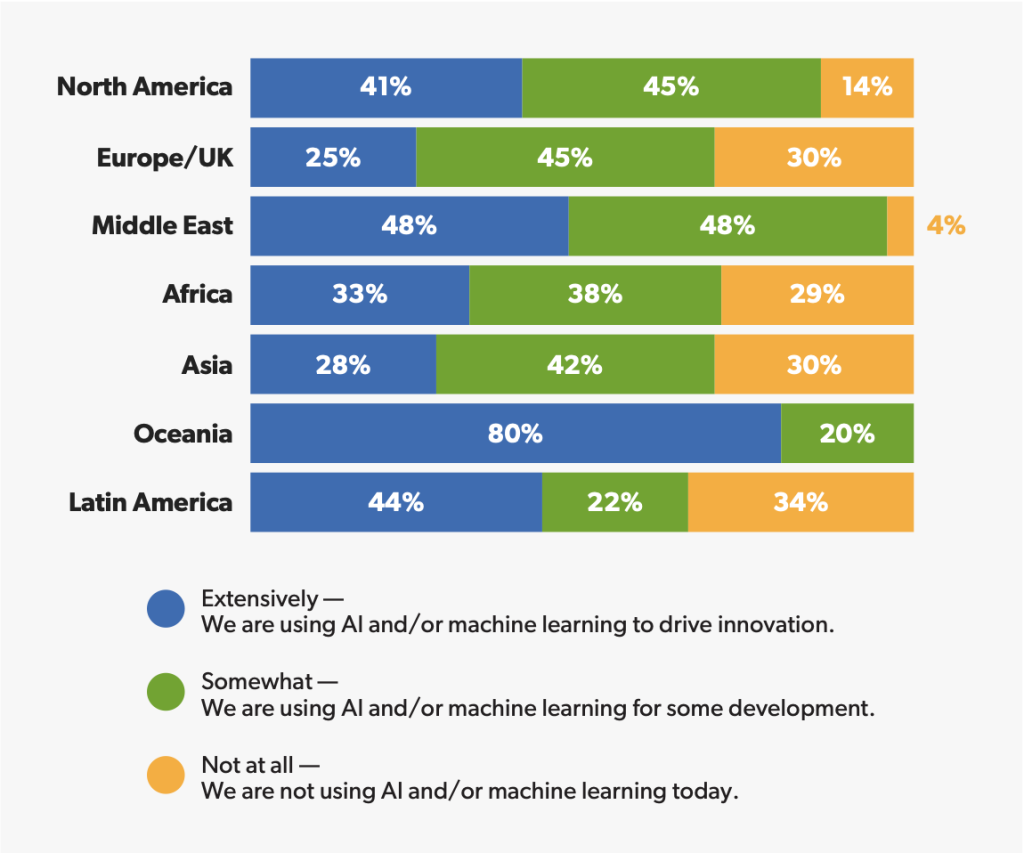

The Report also reveals significant regional variations in the adoption of AI and ML technologies within the automotive industry. Various factors influence these differences, including the maturity of local automotive markets, regional economic conditions, and supportive government policies and infrastructure.

In North America, the adoption of AI and ML is relatively balanced, with 14% of respondents indicating not using these technologies at all, 45% using them somewhat for some development, and 41% are using them extensively to drive innovation. This reflects a solid but cautious approach as companies navigate the complexities of integrating advanced technologies into existing systems while ensuring they meet strict safety and regulatory standards.

In contrast, Europe and the UK show a higher proportion of respondents not using AI and ML technologies (30%), with 45% using them somewhat and only 25% using them extensively. This lower level of extensive use may be attributed to the region’s strict regulatory environment and the significant investment required to adopt these technologies at scale. Interestingly enough, Oceania and Middle East display extensive use of AI/ML – 80% and 48% respectively, which may be attributed to the fact that these regions contain a lot of startups looking at new tech to bring to the automotive space.

Asia shows a significant percentage of respondents not using AI and ML (30%), with 42% using them somewhat and 28% extensively. The region’s increasing focus on diversifying its economy and investing in high-tech industries will likely drive further adoption of AI and ML in the coming years.

Latin America also exhibits unique adoption patterns. In Latin America, 44% of respondents are using AI and ML extensively, 22% using them somewhat, and 34% not using them. This reflects a growing interest in these technologies, albeit at a slower pace due to economic and infrastructural challenges.

These regional differences highlight the diverse landscape of AI and ML adoption in the automotive industry. Each region faces unique challenges and opportunities, influencing how companies integrate these technologies into their design and development processes. As global competition intensifies, understanding and leveraging these regional trends will be crucial for automotive companies looking to innovate and stay ahead in the market.

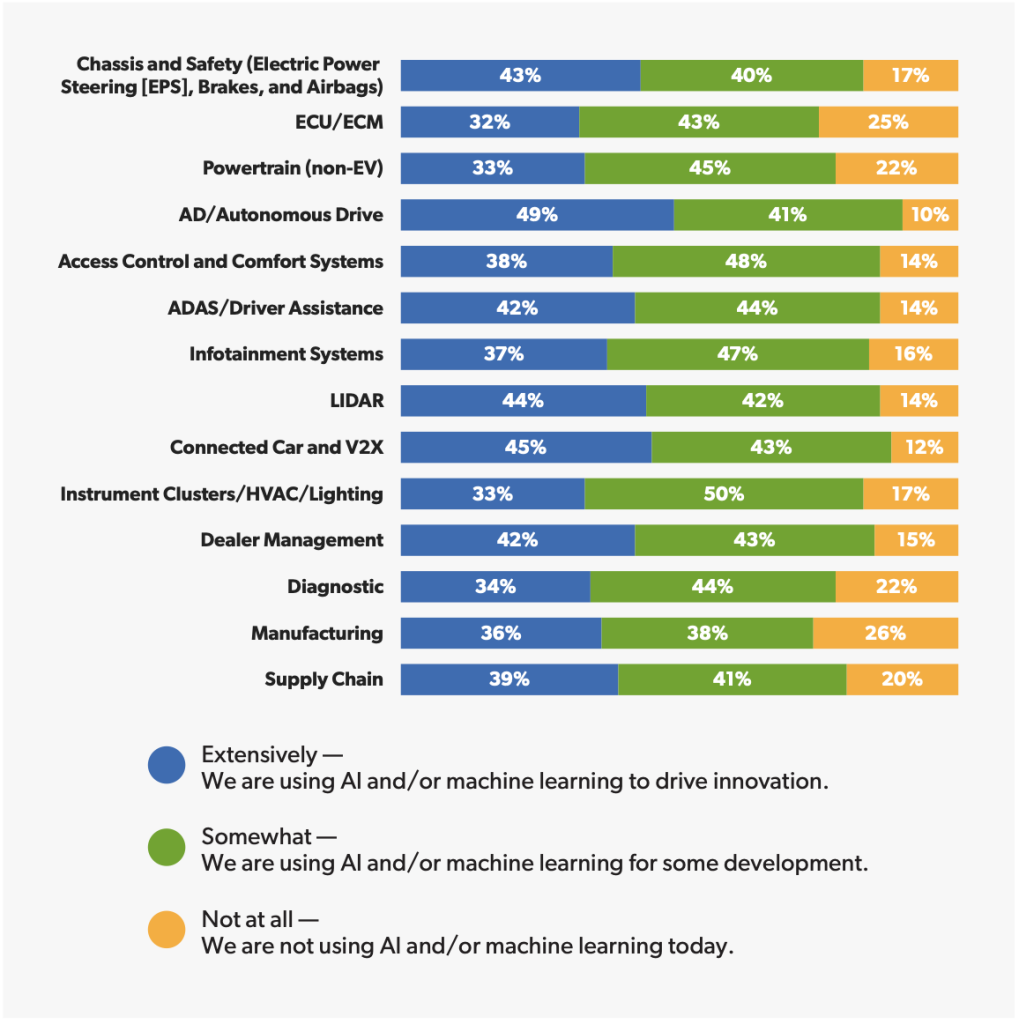

The Report’s data reveals a strong trend of AI/ML adoption across various automotive sectors.

AD/Autonomous Drive: The highest adoption of AI and ML, with 49% of respondents using it extensively and 41% using it somewhat.

Connected Car and V2X: Significant usage, 88% of respondents report using AI/ML extensively and somewhat.

LIDAR: Also shows a high adoption rate, with 44% using it extensively and 42% – somewhat. LIDAR systems use AI algorithms to interpret data from laser sensors to create accurate 3D maps of the environment, helping autonomous vehicles navigate complex driving conditions.

ADAS/Driver Assistance: 42% are using extensively and 44% – somewhat. Powered by AI and ML, ADAS process real-time data from sensors and cameras, enabling adaptive cruise control, automatic emergency braking, and lane-keeping assistance. By continuously learning from data, these systems can predict and react to potential hazards more effectively, instilling a sense of reassurance about the advancements in vehicle safety.

Access Control and Comfort Systems: 38% – extensively and 48% – somewhat.

Infotainment Systems (IVI): 37% are using extensively and 47% – somewhat. AI and ML enhance IVI systems by providing personalized user experiences, such as voice recognition, natural language processing, and recommendation systems for music and navigation. These technologies enable the systems to adapt to user preferences and improve over time, offering a more intuitive and enjoyable driving experience, fuelling excitement about the future of automotive technology.

Supply Chain: 39% – extensively and 41% – somewhat.

Instrument Clusters/HVAC/Lighting: 33% – extensively and 50% – somewhat.

Manufacturing: 36% –extensively and 38% – somewhat.

Chassis and Safety: 43% – extensively and 40% – somewhat.

ECU/ECM: 32% – extensively and 43% – somewhat.

Powertrain (non-EV): 33% – extensively and 45% – somewhat.

Diagnostic: 34% – extensively and 44% – somewhat.

Beyond these primary applications, AI and ML are utilized in several innovative ways within automotive software development.

Cloud data management is one area where AI and ML are used to analyze vast amounts of data collected from connected vehicles. This data can be used to monitor vehicle health, predict maintenance needs, and enhance overall performance.

Many respondents cite predictive maintenance, which uses AI algorithms to analyze data from vehicle sensors to predict when parts might fail. This allows for proactive maintenance that reduces downtime and costs.

Other notable applications include image recognition for object detection, intrusion detection systems for cybersecurity, and telematics and GPS tracking for fleet management. AI and ML are also used to analyze unstructured data for automotive cybersecurity, helping to identify and mitigate potential threats. AI and ML provide precise insights that enhance reliability and safety in assessing vehicle components’ remaining useful life and diagnosis accuracy.

Additionally, these technologies are employed in crash deformation assessments, allowing manufacturers to simulate and analyze crash scenarios to improve vehicle design.

Resource optimization is another critical use case where AI and ML contribute significantly. By optimizing resource allocation in manufacturing processes, these technologies help reduce waste and improve efficiency. This holistic application of AI and ML across various domains drives technological advancements and contributes to the overall sustainability and profitability of the automotive industry.

Based on the data analysis, the following trends can be identified when it comes to AI/ML adoption among different automotive sectors.

Extensive Use of AI/ML: Areas like Autonomous Drive, Connected Car and V2X, LIDAR, and ADAS/Driver Assistance have the highest extensive use of AI and ML, reflecting the industry’s focus on advanced driving technologies and vehicle connectivity.

Broad Adoption: Most domains show a balanced distribution between extensive and somewhat usage, indicating a broad adoption of AI and ML across different functions.

Room for Growth: Manufacturing and Powertrain (non-EV) show higher percentages of non-usage, suggesting these areas might have more barriers to AI/ML integration or are slower to adopt these technologies.

These trends highlight the pivotal role of AI and ML in advancing automotive technology, particularly in areas related to autonomous driving, connectivity, and driver assistance systems.

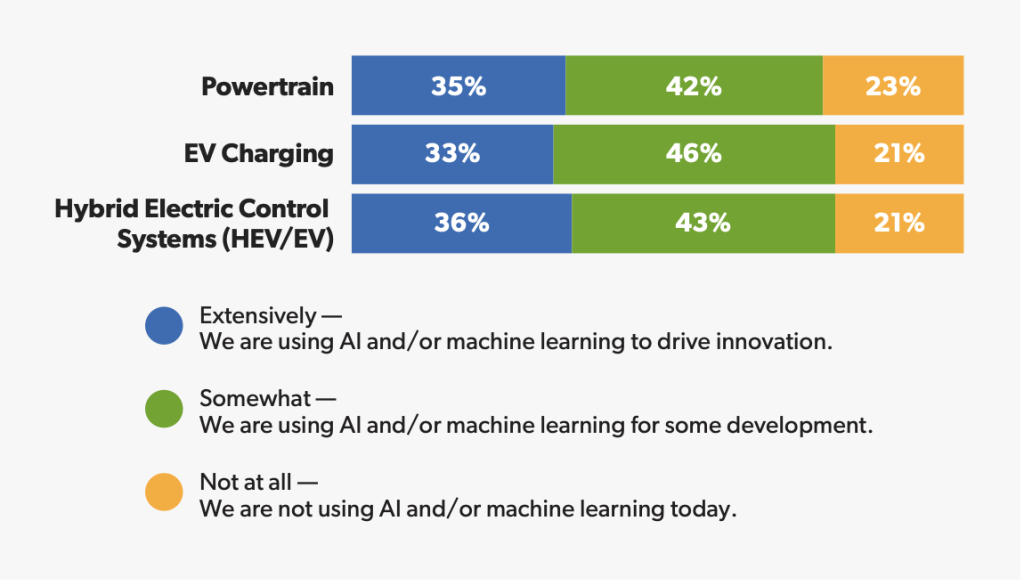

The data reveals a strong trend towards AI/ML adoption across all three areas including Powertrain, EV charging and Hybrid Electric Control Systems (HEV/EV), with the majority of organizations using these technologies to some extent:

High Adoption Rates: Both EV Charging and Hybrid Electric Control Systems show a high level of AI/ML adoption, with 79% of respondents reporting usage either extensively or somewhat. This indicates that these areas are seeing significant innovation driven by AI/ML technologies.

Balanced Adoption in Powertrain: Although slightly lower, Powertrain also shows a balanced adoption with 77% of respondents using AI/ML to some degree. This suggests that while there is a strong push towards modernization, some barriers may still exist in this area.

Extensive vs. Somewhat Use: The data indicates that many organizations are currently in the exploratory or developmental stages of AI/ML integration (as shown by the higher percentages of “somewhat” usage). This reflects an industry-wide trend of gradually increasing reliance on AI/ML as technologies and expertise mature.

Overall, the significant adoption of AI/ML across EV domains suggests that the automotive industry is rapidly embracing these technologies to drive innovation, improve efficiency, and enhance performance. The Report underscores the importance of continued investment in AI/ML to maintain competitiveness and meet the evolving demands of the automotive market.

In 2024, AI and ML are at the forefront of revolutionizing automotive design. As evidenced by the “2024 State of Automotive Software Development Report,” these technologies significantly impact various facets of the automotive industry, from enhancing vehicle safety features to driving innovation in autonomous driving systems and EV technologies. With the automotive sector under pressure to improve efficiency, meet stringent safety standards, and push towards greater connectivity and electrification, AI and ML provide essential tools to address these challenges and seize new opportunities.

The extensive and somewhat usage of AI and ML in areas such as Autonomous Driving, Connected Car and V2X, and ADAS/Driver Assistance reflects the industry’s commitment to advancing vehicle technology and connectivity. Conversely, the notable non-usage in sectors like Manufacturing and Powertrain highlights the ongoing barriers and the need for further integration efforts. Despite these challenges, the overall trend toward AI and ML adoption is clear and promising, driven by the need for competitive advantage and technological advancement.

Global adoption trends of AI and ML reveal diverse approaches and challenges across different markets. While North America demonstrates a balanced adoption pattern, Europe and the UK exhibit cautious adoption due to regulatory and investment barriers. Interestingly, regions like Oceania and the Middle East are showing extensive use, likely driven by innovative startups. Asia and Latin America are on the cusp of a technological revolution as they navigate economic and infrastructural challenges to embrace AI and ML technologies. This global perspective is crucial for stakeholders to understand the industry’s direction and potential opportunities.

AI and ML are not just enhancing current automotive capabilities, they are revolutionizing key areas such as EV Charging, Hybrid Electric Control Systems, and Powertrain. This underscores the automotive industry’s shift towards electric vehicles and sustainable technologies. These advancements are not just incremental improvements, they are paving the way for future innovations, sparking excitement about the possibilities that lie ahead.

In conclusion, the automotive industry’s embrace of AI and ML transforms vehicle design and development, driving efficiency, safety, and innovation. The insights from the 2024 Report highlight these technologies’ critical role in shaping the future of automotive engineering. As the industry continues to evolve, ongoing investment and focus on AI and ML will be crucial for maintaining competitiveness and meeting the ever-evolving demands of the market. For automotive companies, leveraging these technologies effectively will be key to unlocking new potentials and leading the way in the next era of automotive design and innovation.

Let’s talk.

Sharing trends that will shape automotive software development in the months to come.

Exploring how AUTOSAR enhances the security of SOTA updates, ensuring their reliable and safe deployment in software defined vehicles (SDVs).

This article delves into the intricacies of Software Defined Vehicles, exploring their evolution, key components, and the challenges faced in transitioning from traditional cars.