However, there’s a significant difference in factors driving companies to outsource ten years ago and today. In the past, most outsourced their custom software development projects for the sake of cost-saving as a result of labor cost arbitrage. Today, according to Deloitte, companies outsource to unleash marketplace speed and leverage strategic partnerships in order to develop new capabilities, integrate them to create value, and drive that value into the business. That’s what IT Outsourcing 4.0 is referred to.

This article will look into today’s Romanian ICT industry, existing talent pool, and disruptive potential to explore whether Western companies should consider outsourcing their custom software development and R&D projects to Romania.

In May 2021, Eurostat announced that Romania’s economy had seen the highest growth in the EU in the first quarter of 2021, at 2.8%.

A month later, in June 2021, Deloitte listed Romania as one of only six countries in the world (together with China, Chile, Australia, Lithuania, and South Korea) whose GDP had grown during the pandemic.

Global software companies such as Oracle, Amazon, IBM, and Deutsche Bank have already exploited the potential of Romanian software developers at competitive rates compared to Western Europe while maintaining product quality and reducing time to market. They also contributed to the initial development of the tech startup ecosystem that is evolving in leaps and bounds nowadays.

Today, Romania is one of the leading countries in the region in terms of ITO, SSC, and BPO. Companies such as London Stock Exchange Group, Viavi, Huawei, Capgemini, Samsung, Amazon, Accenture have opened centers in Romania for R&D, business services, logistics, custom software development, etc.

Now let’s delve into details.

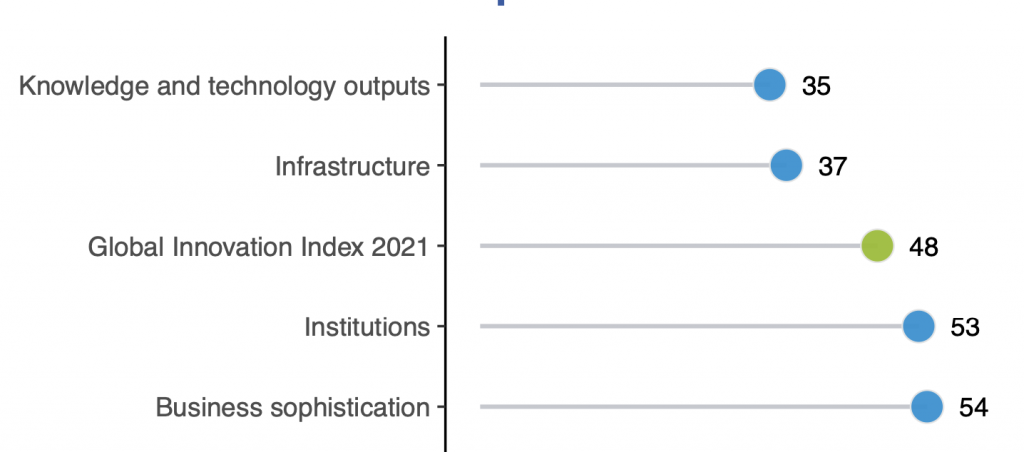

According to the World Intellectual Property Organization (WIPO), Romania ranks 48th among 132 countries in the Global Innovation Index (GII) 2021. Romania performs best in Knowledge and Technology, followed by infrastructure (see below).

Top 5 GII pillar ranks for Romania in 2021

Romania’s IT industry is one of the fastest-growing ones in Central and Eastern Europe. As of 2020, the local ICT market was estimated at $6.4 billion. According to a study by ANIS (Asociația Patronală a Industriei de Software și Servicii), IT exports account for 85% of this value ($5.5 billion).

Almost half of the total revenue ($2.9 billion) comes from large companies with more than 250 employees, followed by small companies (under 50 employees) contributing $2.2 billion, and mid-size companies (50-249 employees) bringing in $1.3 billion.

The country’s leading IT development city is Bucharest, which accounts for 63% of all IT revenues.

Romania’s digital agenda also sets priorities for critical sectors of the Romanian economy and society, such as

The structure of the domestic marketis as follows:

Valued at approximately $5.5 billion in 2021, the Romanian IT exports market has been growing at about 15% annually. The annual outsourcing growth rate is 20%. As much as 90% of ITO services are exported to the EU countries, including Germany, France, the UK, the Netherlands, and the Nordic countries.

Romanian ITO hubs are spread well across the whole country: South (Bucharest, Craiova), Center (Cluj-Napoca, Brasov, Sibiu), West (Timisoara, Oradea), North East (Iasi).

In Romania, software development services aren’t much cheaper than in other Eastern European countries. Yet, they’re cost-effective for Western businesses due to IT labor cost arbirage.

As an ITO buyer, you will have the advantage of working with the second largest pool of software engineers in Europe (after Ukraine) skilled in technologies and domains such as Java, JavaScript, C#, HTML, CSS, Angular, React, Python, DevOps, Machine/Deep Learning, Computer Vision, NLP, data science, cloud, and cybersecurity.

On average, a senior software engineer based in Bucharest makes €50,000 per year. Romanian IT outsourcing companies can provide a good mix of junior, mid-level, and senior talent for client-tailored Managed or Dedicated Teams, helping customers optimize expenses and save software development budgets. At rinf.tech, for instance, we offer 9 service delivery models, from Augmented Teams to turnkey solutions, that can be mixed for the best quality-cost ratio depending on the client’s budget, project complexity, business goals, etc.

Romania boasts the highest per capita technology workforce in Europe.

Here’re some highlights:

According to the National Institute of Statistics, Romania’s ICT sector evolution is the major driver for the automotive, aerospace, chemical, agriculture, and many other sectors and Industry 4.0 as a whole.

In terms of cyber education, in the 2019-2020 academic year, more than 15 cybersecurity programs were developed across the country, focusing on cybersecurity of military information systems, cryptography, and digital research on machine learning and network security.

In terms of gender balance, Romania is ranked 3rd in the EU for women working in ICT: 24% of tech graduates in Romania are women, marking one of the most inclusive and gender-balanced work cultures and environments.

Companies doing business in Romania can receive an additional deduction of 50% on their respective research and development costs. In addition, accelerated depreciation can be applied to technologies and equipment used in R&D. For large investments, public assistance schemes or individual assistance are available.

Romania does not tax the income of IT employees involved in software development. Thus, Romania is one of the most competitive markets for outsourcing, with an average annual labor cost of 67,000 RON ($15,300) in software development.

Cybersecurity is one of the leading components of the ICT sector in Romania. According to Trade.Gov, Romania’s National Digital Agenda 2020 Strategy, the full implementation of the cyber security-based strategic vision will require a total investment of about $2.64 billion.

In 2021, Bucharest has become home to the European Competence Center for Industrial, Technological, and Research Cybersecurity – an EU special agency tasked with funding and coordinating cybersecurity research projects for encryption and network security all over Europe.

According to the International Federation of Robotics (IFR), there are about industrial 3,100 robots in Romania, of which 40% are used in the automotive industry.

Pilot and full-fledged robotic solutions built in Romania have received accolades and been acknowledged on the global scene. In 2021, a Romanian robotics team made up of students from Traian Lalescu High School in Hunedoara won the first prize in the health category at the FIRST Global Challenge international robotics competition.

The participating teams were tasked with identifying a pandemic-related issue in their community across education, environment, health, or economics, and then creating a robotic prototype to address it. The winning team from Romania offered an inexpensive scalable healthcare solution including an autonomous robot sterilizer using UV radiation.

Custom robotic development is gaining traction in Romania, as more companies big and small consider robots to be the new sources for additional business value generation. Currently, 24% of SMEs in Romania confirm they need software robots to accelerate business digitization and improve operational efficiency by automating operations, according to a 2021 study by Tailent.

Custom robotic development outsourcing to Romania is another prospective area, as the country has accumulated solid know-how and deep domain knowledge from the delivery of custom automotive projects that rely heavily on IoT, embedded development, robotics, and AI tech.

We at rinf.tech have a Robotic Division that both provides RPA and bespoke product and services robotization solutions and builds our own enterprise robots for different industries within Romania and abroad.

In 2020, Romania was one of the four countries to have agreed to work together with 20 other EU Member States towards developing a quantum communication infrastructure (QCI) across Europe. The QCI aims to enhance European capabilities in quantum computing technology and industrial competitiveness.

"We will actively contribute to the development of quantum technologies by playing to our strengths: lasers, nanotechnologies, and quantum theory, among others. As one of the driving technologies of the 21st century, quantum technologies will have a major impact on our lives by making Europe a better, safer, and more competitive place to live and work."

Dragos Ciuparu, Romania's State Secretary for Research Tweet

Following the national agenda for future technologies and quantum, in particular, we at rinf.tech have launched a Quantum Computing training for our employees that will be conducted by a Deutsche Bank consultant. With this initiative, we’re aiming to contribute to the future readiness of our software engineering talent.

Germany’s automotive industry is one of the most active outsourcers to Romania.

In 2018, the German engineering and electronics company Bosch Engineering took advantage of Romania’s potential as an R&D center. The company has invested €30 million in its engineering center headquartered in Cluj-Napoca, which was completed in 2020. The center develops software, hardware, and products for mechanical engineering in autonomous driving, electric vehicles, and the Internet of Things (IoT).

Ford announced this year that it will invest $300 million in producing a new light commercial vehicle at its Craiova plant in Romania, starting in 2023. Craiova follows two other Ford businesses focused on the production of all-electric cars, the Cologne Electrified Vehicle Center in Germany and the Kocaeli plant in Turkey. Thanks to this expansion, Ford’s total investment in its manufacturing operations in Romania has approached $2 billion since 2008.

“Ford’s Craiova operations have proven to be globally competitive and flexible,” said Stuart Rowley, President, Ford of Europe, announcing the project. “Our plan to build this new light commercial vehicle in Romania reflects our continued positive partnership with local suppliers and the community, as well as the success of the entire Ford Craiova team.”

Porsche Engineering, a technology service provider and a subsidiary of Porsche, has chosen Timisoara to host its second R&D center in Romania. The aim is to expand the network of innovation centers into developing future cars: smart and connected. For Romania, this is another boon to developing high-tech automotive innovation projects.

“Five years ago, when we first came to Romania, we were impressed with the creativity, flexibility, and fast learning ability of the people we met,” says Dirk Lappé, Technical Director of Porsche Engineering. According to him, the company is “delighted to continue to exploit this potential” in the future.

As an innovative philosophy, Porsche Engineering combines the latest in software technology, functions, and capabilities with automotive expertise to create more intelligent, efficient, and user-friendly vehicles. Following their success in Cluj-Napoca, the company chose Timisoara for its high-tech direction in both academia and industry.

This will create about 300 new jobs in the automotive industry in Timisoara in 2022 and beyond. Opportunities will emerge primarily in software development and testing, focusing on automated driving functions, machine learning, virtual energy management, and digital cockpit trends. The Porsche Engineering management team is particularly encouraged by the opportunities offered by the city’s technical universities. It plans to partner with the Polytechnic University of Timisoara and the Western University of Timisoara for joint projects.

At rinf.tech, we have a robust Automotive Software Development Division in Timisoara that provides custom development services to some of the leading German OEMs and Tier 1 providers.

Based on our firsthand experience, the following types of projects have the highest demand for outsourcing among automotive companies so far:

Technology is considered the main engine of growth in Romania, with an annual investment growth of €20 million, according to Romania’s Employers’ Association of the Software and Services Industry (ANIS).

Germany remains Romania’s largest trading partner, with a volume of €30.9 billion estimated in 2020. The trade volume between the two countries in the first six months of 2021 amounted to €16.4 billion (20.5% increase). It’s projected to exceed €32 billion by 2022, according to AHK.

According to EY Digital Investment Index, the Romanian M&A market was impacted by the COVID-19 pandemic, resulting in delays or suspended deals. While H1 2020 saw a significant slowdown in growth, H2 2020 saw an unexpected return. KPMG and PwC’s 2021 M&A forecast for Romania suggests that healthy transaction numbers are mapped this year despite the ongoing pandemic.

As per EY, the expected growth in M&A activity is driven by the fact that nearly two-thirds (62%) of CEOs globally believe their organizations must radically transform their operations over the next two years. To achieve this, they are beginning to turn to new technologies, among which the most likely investments in the next two years are:

Fifty-two percent of CEOs who have dived into the digital space through M&A with Romanian companies said the approach exceeded expectations, and 45% reported similarly on tech partnerships, expecting more deals, corporate venture capital, and investments in 2021.

We’ll make sure to update you on whether their expectations were met once the 2021 stats and figures have been released.

January 2021: ThoughtWorks acquires Gemini

A global software consulting firm ThoughtWorks, backed by private equity firm Apax Partners, acquired Gemini Solutions, a privately held software development and consulting services firm based in Silicon Valley. The terms of the deal were not disclosed. Gemini Solutions was founded in 2005 and provides software and product development services. The company has over 170 employees, including software engineers and operations staff based in Romania “covering a broad spectrum of technologies across the entire software product development life cycle”.

This M&A resulted in the establishment of Thoughtworks Romania with the Gemini Solutions team at its core.

February 2021: Orion acquires Tellence

New Jersey-based Orion Innovation, backed by private equity firm One Equity Partners (OEP), acquired Tellence Technologies, a technology services company headquartered in Bucharest. Tellence, founded in 2012, develops digital technologies for companies in telecommunications and media, cybersecurity, and other industries. The financial terms of the deal were not disclosed.

April 2021: Wipro acquires Metro Systems

IT services giant Wipro has announced the completion of the $63 million acquisition of Metro-NOM GMBH and Metro Systems Romania SRL as part of its digital and IT partnership with Metro AG.

Our research shows that Romania is an Outsourcing 4.0 ready destination due to the following facts:

Wrapping up, the Romanian ICT sector can become a one-stop shop for foreign investors, assisting and advising international companies and startups on cutting-edge project implementation and evolution.

Copyright © 2023 rinf.tech. All Rights Reserved.

Terms & Conditions. Cookie Policy. Privacy Policy.

Politica Avertizari de Integritate (RO)